Synopsis

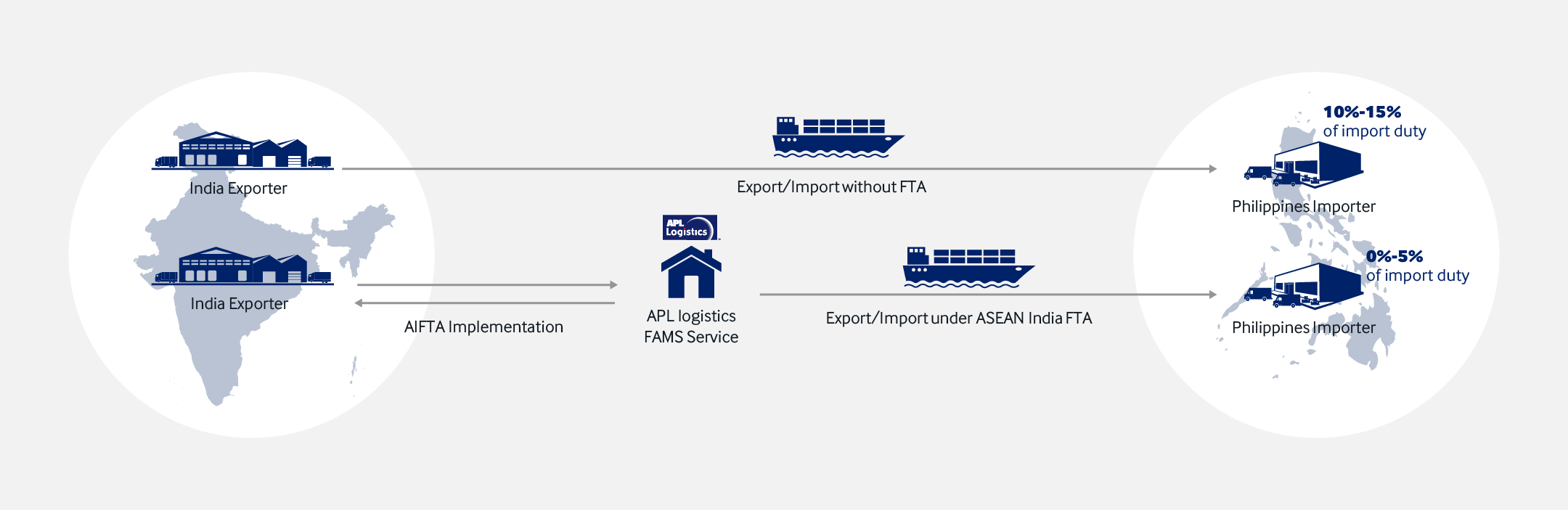

A large solar energy company with manufacturing operations in India was able to reduce its total customs duty spend in the Philippines by 10% through the use of the ASEAN-India Free Trade Agreement.

Customer Overview

- Company: A large manufacturer of solar energy products

- Vertical: Industrial

- Services: GTCM FAMS

- Volume: Approximately 10 containers of products classified under 40 different HS codes

Challenges

- Need to verify product classifications of various products to validate compliance with “change in tariff heading” FTA criteria

- Obtaining the required preferential Certificate of Origin (Form AI)

- Additional documentation may impact timely shipment clearance at origin and destination

M&H Haulage Group Solutions

- Review classification of all products in shipment for FTA purposes

- Review HS codes of raw materials (through Bill of Materials), and ascertain that the finished product underwent a “change in tariff heading”

- Consultation with customs at origin and destination to develop procedures and controls to manage compliance

Benefits

- Duty savings benefit averaging 10%

- Smoother and hassle-free shipment clearance despite additional documentation requirements